Monthly closing checklist lays the groundwork for a smooth financial wrap-up, offering a structured approach that ensures nothing slips through the cracks. It’s an essential tool for businesses aiming to maintain accuracy and efficiency in their financial processes.

This checklist encapsulates critical components like necessary documentation and step-by-step procedures, blending practical application with strategic insights that can elevate a company’s performance.

Monthly Closing Checklist Essentials

The monthly closing checklist is a pivotal aspect of financial management for any business. This structured process ensures that all financial transactions have been accurately recorded and that the financial statements reflect the true state of the business. A well-organized closing procedure provides transparency, facilitates better decision-making, and ensures compliance with accounting standards.Critical components of a monthly closing checklist encompass all necessary steps and documentation needed for an accurate closing process.

This includes verifying journal entries, reconciling accounts, and preparing essential financial reports. The goal is to render precise financial insights that aid in assessing the company’s performance and planning for future strategies.

Critical Components of a Monthly Closing Checklist

To maintain an effective monthly closing process, the following components should be included in the checklist:

- Review all journal entries for accuracy and completeness.

- Reconcile bank statements with the general ledger.

- Verify accounts receivable and accounts payable balances.

- Ensure all invoices are processed and recorded.

- Post month-end adjustments and accruals.

- Prepare preliminary financial statements for review.

- Document any discrepancies and make necessary corrections.

Each of these steps plays a crucial role in ensuring the integrity of financial data, which is essential for stakeholders relying on these reports.

Necessary Documentation for Accurate Monthly Closing

Accurate monthly closing requires specific documentation to support the financial activities of the business. The following documents are essential:

- Bank statements and reconciliations.

- Sales and purchase invoices.

- Expense reports and receipts.

- Payroll records and related journals.

- Inventory counts and valuation reports.

- Tax documents and related filings.

Having these documents readily available facilitates a smoother closing process, allowing for quick verification and correction of entries when needed.

Step-by-Step Procedure for Executing the Monthly Closing Process

The monthly closing process can be streamlined by following a structured, step-by-step approach. The procedure is as follows:

- Collect all financial documents relevant to the month, including invoices, bank statements, and expense reports.

- Verify and post all journal entries to ensure all transactions are recorded.

- Reconcile bank accounts to ensure all cash transactions align with bank statements.

- Review accounts receivable and accounts payable for any discrepancies.

- Perform inventory counts and adjustments to ensure accurate reporting of assets.

- Prepare financial statements, including the income statement, balance sheet, and cash flow statement.

- Review financial statements for irregularities and make necessary adjustments.

- Finalize the closing entries, ensuring all adjustments are accurately reflected in the system.

- Document the closing process and any findings for future reference.

This systematic approach not only ensures accuracy but also enhances the efficiency of the financial closing process, providing a clearer picture of the company’s financial health each month.

Integration with Business Functions

The monthly closing checklist serves as a pivotal tool in harmonizing various business functions, ensuring that financial accounting practices are seamlessly integrated into the broader organizational framework. By methodically addressing each task, businesses can enhance their financial accuracy and streamline operations. This integration not only fosters accountability within accounting teams but also enhances overall business performance.

Impact on Business Accounting Practices

The monthly closing checklist significantly influences accounting practices by establishing a routine that encourages meticulous financial review and reconciliation. Regularly employing this checklist aids in identifying discrepancies early, ultimately reducing the chances of financial misstatements. Furthermore, the checklist promotes consistency across accounting periods, allowing for better comparison and analysis over time.

- Enhanced Accuracy: By following a routine checklist, accountants can ensure that all necessary financial statements are prepared accurately and in compliance with regulatory standards.

- Timely Reporting: The checklist helps in setting deadlines for various accounting tasks, ensuring that reports are generated on time for stakeholders’ review.

- Streamlined Processes: Regularly utilizing the checklist allows businesses to identify bottlenecks and improve inefficient practices, leading to a smoother closing process.

The use of a monthly closing checklist transforms accounting from a reactive to a proactive function within the business.

Role in Business Management and Strategy Development

The checklist plays a crucial role in supporting effective business management and the development of strategic initiatives. By providing clear visibility into financial health, management can make informed decisions that drive growth and sustainability. The strategic insights derived from the closing process help in setting realistic goals and benchmarks for the organization.

- Informed Decision-Making: A comprehensive understanding of monthly financials allows management to allocate resources where they are needed most.

- Performance Evaluation: Regular closing activities provide critical data that can be used to evaluate business performance against established KPIs.

- Long-term Planning: Trends identified through monthly closing reports can influence future business strategies, ensuring alignment with overall organizational goals.

Incorporating monthly financial reviews into strategic planning fosters a culture of accountability and foresight within the organization.

Branding and Efficiency in the Monthly Closing Process

Effective branding can enhance the efficiency of the monthly closing process by promoting a culture of precision and professionalism. A strong brand identity that values accurate financial reporting reinforces commitment among employees and stakeholders alike.When a company’s brand emphasizes the importance of transparent financial practices, it encourages a collective responsibility towards achieving timely and accurate closings.

- Employee Engagement: A well-branded culture fosters higher employee engagement and accountability in the closing process.

- Stakeholder Trust: Consistent and reliable financial reporting bolstered by a strong brand can enhance stakeholder trust and confidence in the organization’s operations.

- Competitive Advantage: Organizations that efficiently close their books often gain a competitive edge, as they can respond quicker to market changes and make informed decisions faster.

A strong brand not only sets expectations but also drives a culture that prioritizes accuracy and efficiency in financial practices.

Best Practices and Tools

Maintaining an efficient monthly closing checklist is essential for ensuring accuracy, compliance, and timely financial reporting. A well-structured checklist not only streamlines the closing process but also minimizes errors and enhances collaboration among team members. By implementing best practices and utilizing the right tools, businesses can significantly improve their monthly closing efficiency.

Best Practices for Maintaining an Efficient Monthly Closing Checklist

It is important to establish a clear and consistent approach for the monthly closing process. The following best practices can help in achieving an efficient monthly closing checklist:

- Standardization: Create a standardized checklist that is used across the organization. This ensures that all necessary steps are consistently followed, minimizing discrepancies.

- Clear Responsibilities: Assign specific tasks to individuals or teams, so everyone knows their roles and deadlines. This accountability helps in keeping the process organized.

- Regular Updates: Continuously update the checklist based on feedback and changes in business processes. This ensures that it remains relevant and effective.

- Documentation: Maintain thorough documentation for each step in the checklist. This provides a clear record for audits and helps in training new employees.

- Review Process: Build in a review process to verify that each task is completed accurately before moving on to the next. This can help catch errors early.

Tools and Software for Creating and Managing a Monthly Closing Checklist

Utilizing the right tools can enhance efficiency and accuracy in managing a monthly closing checklist. Here’s a comparison of various tools available for this purpose:

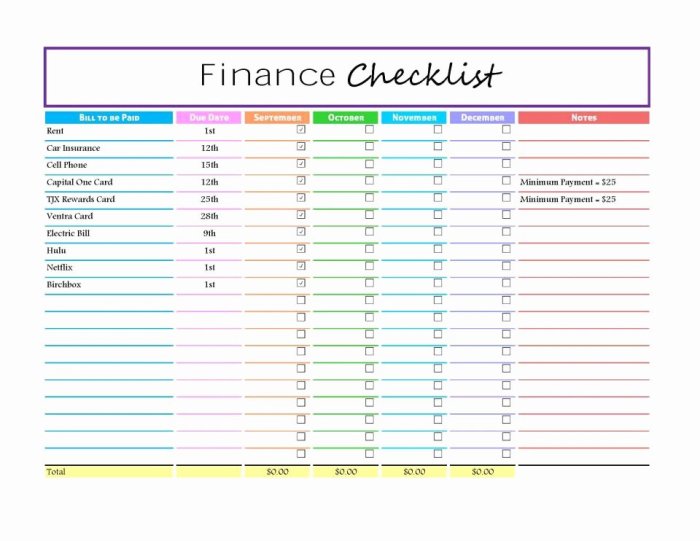

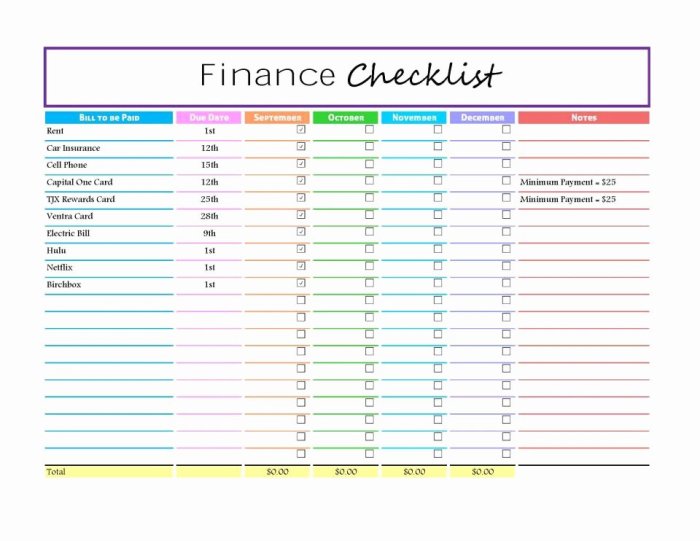

- Excel Spreadsheets: Widely used for its flexibility and customization options. Excel allows users to create tailored checklists but may lack automation features.

- Accounting Software (e.g., QuickBooks, Xero): These platforms often come with built-in closing checklists and reporting features, making the process smoother. They provide real-time data and integrations with other financial tools.

- Project Management Tools (e.g., Trello, Asana): These tools can effectively manage tasks and deadlines, providing visual representations of progress. They are useful for collaboration across teams.

- Dedicated Closing Software (e.g., FloQast, BlackLine): Specifically designed for the closing process, these solutions automate various tasks, provide checklists, and facilitate communication among team members.

Each tool has its unique advantages, and the choice depends on the specific needs of the organization, including size, complexity, and workflow.

Training Employees on the Importance of a Monthly Closing Checklist

Training employees on the significance of the monthly closing checklist is critical for fostering a culture of accuracy and compliance. Effective training methods include:

- Workshops: Organizing hands-on workshops that provide practical experience in using the checklist can enhance understanding and retention.

- Onboarding Programs: Incorporating checklist training into onboarding processes ensures that new employees are aware of its importance from the start.

- Regular Refreshers: Scheduling monthly or quarterly refreshers can help keep the team updated on any changes or improvements in the checklist.

- Feedback Loop: Encouraging team members to share their experiences and suggestions helps create a collaborative environment for continuous improvement.

By investing time and resources into training, businesses can build a knowledgeable workforce that values the monthly closing process and contributes to overall financial integrity.

Closing Summary

In conclusion, embracing a monthly closing checklist not only safeguards financial integrity but also empowers businesses to refine their operational strategies. By following best practices and utilizing effective tools, companies can streamline their processes, ultimately leading to better decision-making and enhanced overall performance.

FAQ Corner

What is a monthly closing checklist?

A monthly closing checklist is a structured guide that Artikels all necessary tasks and documentation needed to close the financial books each month.

Why is a monthly closing checklist important?

It ensures accuracy in financial reporting and helps identify discrepancies or issues before they escalate.

How often should I review my monthly closing checklist?

It should be reviewed and possibly updated every month to reflect any changes in procedures or requirements.

Can software tools facilitate the monthly closing process?

Yes, various software tools are designed to streamline the monthly closing process, making it easier to manage tasks and documentation.

Who should be involved in the monthly closing process?

Typically, accounting and finance teams are primarily involved, but collaboration with other departments is also beneficial to ensure accuracy.